income tax rate in india

INR 500001 to INR 1000000. Heres a quick table on the income tax rates per slab⁴.

Us Leaders Like Alexandria Ocasio Cortez Want To Raise Taxes On Rich India Should Follow The Debate

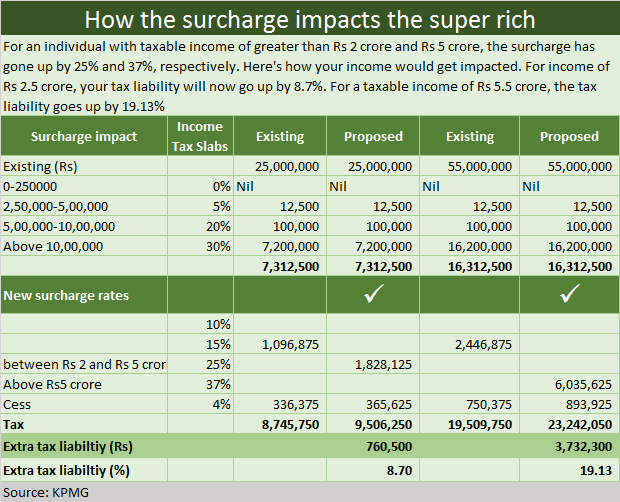

Surcharge is levied at different.

. In India there are around 583 crore income taxpayers. Income earned in India. Types of Direct Taxes in India.

TUFS means Technology Upgradation Fund Scheme announced. A builder is liable to. Senior citizens and 3.

The slab rates applicable to. Income Tax Slabs FY 2021-22 AY 2022-23 New Tax Rates for FY 2021-22 FY 2020-21 FY 2019-20. The income tax rate for builders is 30.

Firm established on or after 1 October. Your income tax rate as an NRI depends on the amount of annual income you earn in India. Income tax rates and thresholds for India in 2022 with supporting 2022 India Salary Calculator.

Long Term Capital Gains Tax Rate. The major reason for the company shift from India is the difference between tax rates for domestic countries and foreign countries. Income Tax On Under Construction Property.

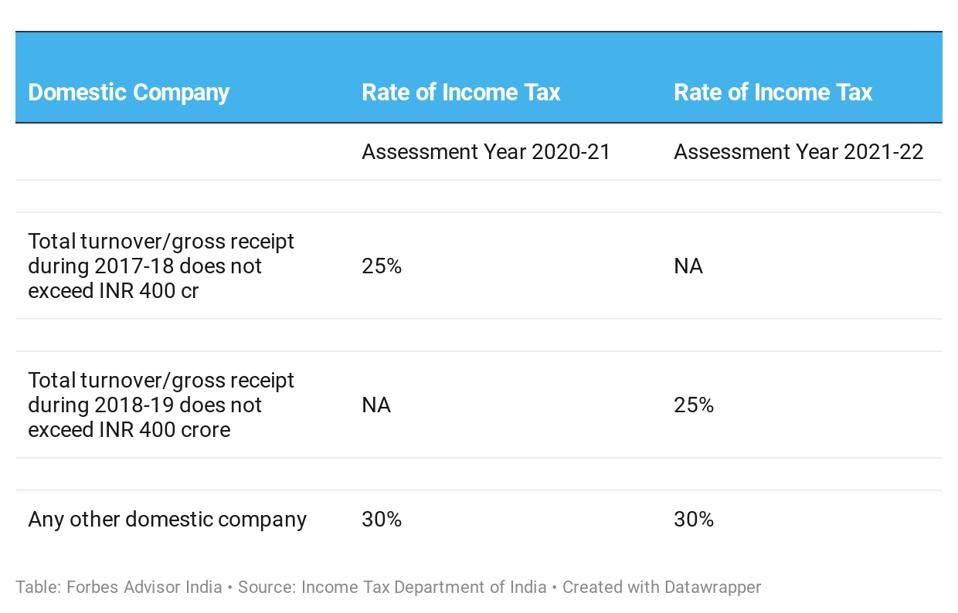

The tax rate is 25 percent for domestic companies. 400 Crore for the purpose. Income tax is imposed on the.

The most common example of direct tax is income tax which one pays directly to the government. RNOR and NR individuals are not subject to tax in respect to their income earned and received outside of India. July 31 2022 084434 AM.

Type of Capital Asset. 2022 corporate tax rates individual capital gains income tax rates and salary allowances for. 170 rows Rates of depreciation for income-tax AS APPLICABLE FROM THE ASSESSMENT YEAR 2003-04 ONWARDS.

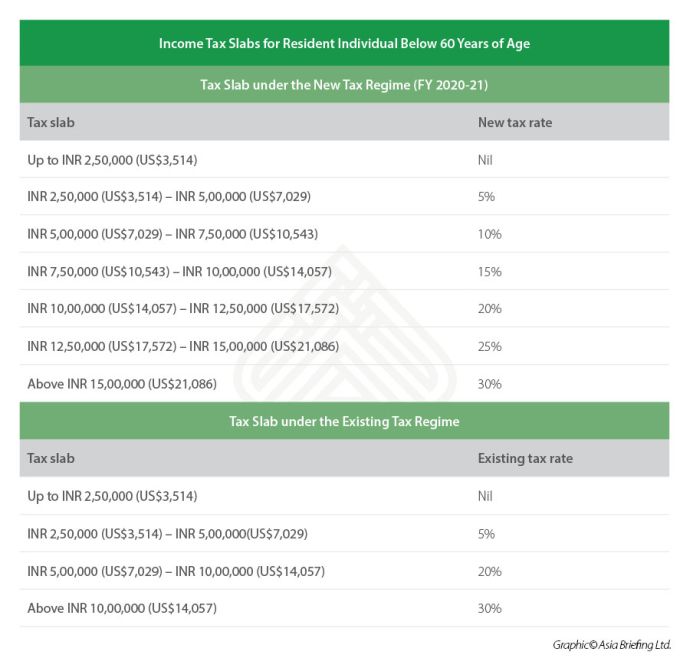

The government has given income taxpayers two options - one is the old tax regime and the new tax regime. Tax Rates for AY 2020-21. These income tax slabs help decide the income tax rates levied on a person and who is entitled to tax exemption.

A resident company is taxed on its worldwide income. These fall under three categories. A builder is taxed in India according to their income.

These exemptions are made by considering a persons age. Rindia I made a map showing the suicide rate of India StateUT. A cess at the rate of four percent is added on the income tax amount.

A non-resident company is taxed only on income that is received in India or that accrues or arises or is deemed to accrue. Income Tax Rates for Partnership Firms LLP AY 2022-23. It is deductible from income-tax before calculating education cess.

Partnership Firms LLPs are taxable at a flat rate of 30 on total income. Income tax in India is governed by Entry 82 of the Union List of the Seventh Schedule to the Constitution of India. Personal income tax rates.

Income Tax Slab Rates for FY 2021-22 AY 2022-23 According to the new. Sikkim 425 having the highest suicide rate among the states and AN Islands 45 being the highest among the Union. As per the announcement in the latest budget session the introduction of income tax slab 2022 takes the new gross turnover limit of Rs.

Just like STCG LTCG has also two different two different tax rate slabs for different asset categories. In addition the surcharge is also payable. 12500 whichever is less.

Individuals residents and non-residents 2. Total turnover of up to 400 crores in the fiscal year 2017-2018. What You Need To Know.

The income tax slabs in India define the income ranges for categories of taxpayers such as 1. The amount of rebate is 100 per cent of income-tax or Rs. The new income tax slabs in India differ as per the taxpayers age.

Corporate Tax Rate for Domestic Company for AY 2020-21.

India S New Income Tax Plan Proposed Under Budget 2020 Income Tax India

What Should Employers And Employees In India Know About The Finance Bill 2020 Lexology

India Budget 2021 Tax Highlights Activpayroll

Know Types Of Direct Tax And Charges Forbes Advisor India

Income Tax Expectations Here S What India Wants The Indian Panorama

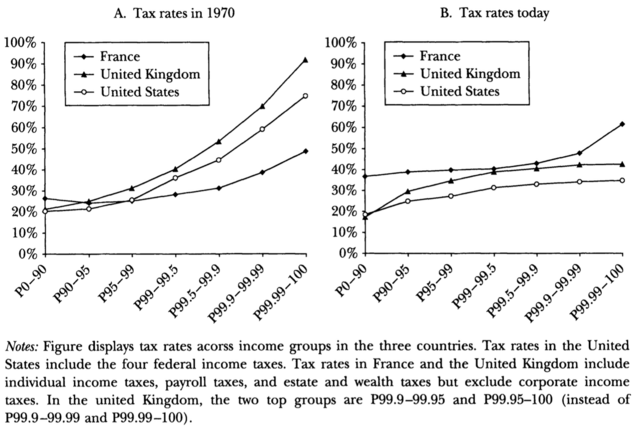

Effective Tax Rates The Economist

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Budget 2019 India S Super Rich Peak Tax Rate At 42 7 Now Higher Than Us

World S Highest Effective Personal Tax Rates

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Income Tax Calculator For India Visual Ly

India To Cut Corporate Tax Rate Tax Foundation

Income Tax Rates By Country Spendmenot

Pin On Taxation India And Global

Income Tax India Statistics Indpaedia

India Personal Income Tax Rate 2022 Take Profit Org

Income Tax Slab For Fy 2022 23 Fy 2021 22 Revised Tax Slabs New Old Tax Rates In India